China’s Zero-Tariff Bombshell: 53 African Nations Get Full Market Access from May 2026

In a move that reshapes the competitive landscape for global supply chains across Africa, Chinese President Xi Jinping announced at the African Union Summit that China will eliminate import tariffs on goods from 53 African countries starting May 1, 2026, covering 100% of tariff lines. This represents the most sweeping trade liberalization measure in the history of China-Africa economic relations, extending far beyond the partial zero-tariff arrangements previously granted to 33 nations. The only exception is Eswatini, excluded due to its diplomatic recognition of Taiwan, underscoring the geopolitical dimensions that inevitably accompany such landmark trade decisions.

The scale of the bilateral relationship provides essential context. China-Africa trade reached $348 billion in 2025, growing 17.7% year-over-year, but the structural imbalance remains stark: Chinese exports to Africa totaled $225 billion while African exports to China stood at just $123 billion, producing a $102 billion trade deficit. Beijing estimates the zero-tariff policy will cost approximately $1.4 billion in foregone customs revenue — a modest price for the strategic advantages it is designed to secure. A complementary “green lane” initiative will fast-track customs and quarantine procedures, systematically reducing the institutional barriers that African exporters face when accessing the Chinese market.

The timing is anything but coincidental. The United States recently imposed 30% tariffs on South African imports, and the African Growth and Opportunity Act (AGOA) has been steadily losing its practical relevance. China’s zero-tariff announcement creates a stark contrast with Washington’s protectionist trajectory, offering African exporters a more predictable and welcoming alternative market. This is not merely an economic calculation — it is a precisely calibrated move in the broader geopolitical competition for influence across the world’s fastest-growing continent.

The CAEPA Framework: South Africa as the Supply Chain Partnership Blueprint

Within the broader zero-tariff architecture, the China-Africa Economic Partnership Agreement (CAEPA) signed between South Africa and China deserves particular attention. South Africa’s Minister of Trade, Industry and Competition, Parks Tau, highlighted the “significant and steady increase in Chinese investments in South Africa,” noting that the Early Harvest Agreement — expected by the end of March 2026 — will grant South African exports priority duty-free access to the Chinese market. International relations expert Dr. Oscar van Heerden characterized the deal as “extremely significant,” emphasizing that “all goods exported to China will be tariff-free, offering a huge boost for agriculture and manufacturing.”

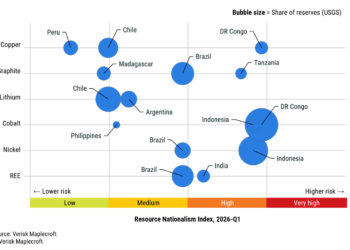

The CAEPA’s scope spans mining, agriculture, renewable energy, and technology — essentially every pillar of South Africa’s economy. Chinese automotive companies have already established manufacturing operations in the country, and the Motor Industry Staff Association (MISA), representing 75,000 workers, publicly endorsed the agreement as a catalyst for “accelerating Chinese investment and creating more employment.” From a supply chain perspective, South Africa’s reserves of platinum, manganese, chromium, and vanadium position it as a critical node in battery and clean energy value chains. Chinese firms can establish processing facilities there and leverage AfCFTA to serve the entire African continental market — a classic hub-and-spoke supply chain strategy.

However, President Cyril Ramaphosa expressed measured reservations about the persistent trade imbalance, a concern that supply chain professionals should take seriously. If South Africa fails to develop local processing capabilities, zero tariffs may simply redirect raw material flows to a different destination without driving genuine industrial upgrading. The challenge for policymakers is clear: how to convert market access into domestic value creation rather than deeper resource dependency. This tension between access and agency will define the success or failure of CAEPA as a supply chain partnership model.

Sign in to read the full article

Sign in with your AI Passport account to access this content.

Sign InDon't have an account? Sign up free