A Landmark Risk Assessment Reframes South America’s Strategic Role

In February 2026, risk consultancy Verisk Maplecroft published what may prove to be one of the most consequential supply chain intelligence reports of the year. By systematically evaluating 10 emerging markets with major reserves of cobalt, copper, graphite, lithium, nickel, and rare earth elements, the firm delivered a clear verdict: South American nations exhibit “comparatively lower resource nationalism risk” and could be “key” to the West’s restructuring of critical minerals supply chains. The countries assessed — Argentina, Brazil, Chile, the Democratic Republic of the Congo (DRC), India, Indonesia, Madagascar, Peru, the Philippines, and Tanzania — span every major resource-rich region on the planet, making the findings a genuine global benchmark.

The timing could not be more significant. The world is navigating the most profound supply chain realignment since the Cold War, with critical minerals at its epicenter. From electric vehicle batteries to semiconductor manufacturing, from renewable energy infrastructure to defense systems, these materials underpin the technologies that will define economic competitiveness and national security for decades to come. China currently controls 60-70% of global rare earth mining and 85-90% of processing capacity, a concentration that Western governments have belatedly recognized as a strategic vulnerability of the first order. Against this backdrop, Verisk Maplecroft’s assessment elevates South America from a peripheral player to a central pillar of the emerging post-China minerals architecture.

Decoding the Resource Nationalism Index: What Sets South America Apart

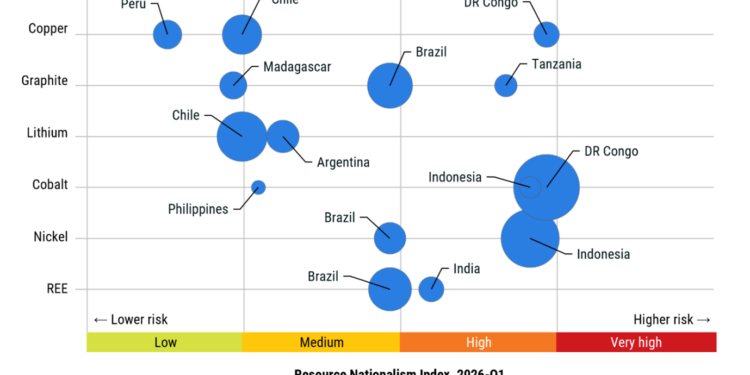

Maplecroft’s methodology centers on its proprietary resource nationalism index, which quantifies the degree of government control over extractive-sector economic activity — encompassing taxation regimes, state ownership mandates, export restrictions, and regulatory unpredictability. The results reveal a stark geographic divide: the DRC, Indonesia, and Tanzania all rank within the global top 20 highest-risk environments for resource nationalism, while Peru, Chile, and Argentina occupy markedly lower positions on the risk spectrum.

Chief analyst Jimena Blanco attributed this divergence to the “distribution of risk” that sets South America apart, noting it explains “the intensifying US and EU focus” on the region. Simon Wolfe, co-founder of geopolitical advisory firm Marlow Global, reinforced this assessment with a practitioner’s perspective: South American jurisdictions possess “reliable legal systems, the rule of law, established mining frameworks, and long track records of hosting international operators.” Most critically for investors with multi-decade horizons, the ability to “enforce contracts and repatriate capital” distinguishes the region — “asset seizures common in other regions are rare in South America.” For mining operations that may not generate returns for a decade or more, this institutional stability is not merely reassuring; it is a prerequisite for capital deployment at scale.

Sign in to read the full article

Sign in with your AI Passport account to access this content.

Sign InDon't have an account? Sign up free